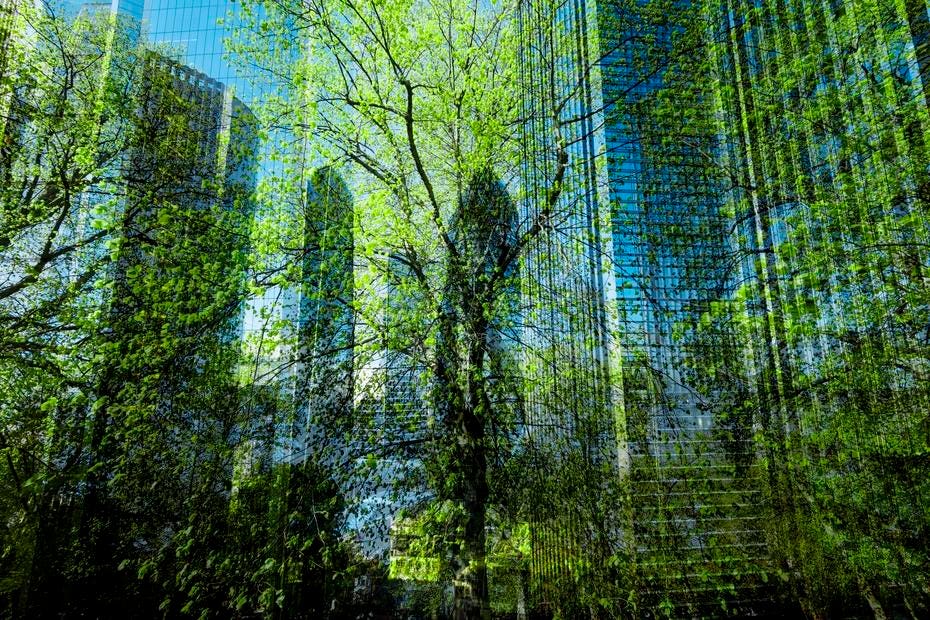

Summary

Insurers rely on historical data to price risk. But climate change is making the past an unreliable predictor. Events once considered once in a century are now happening more often every 10 or 20 years in some cases. As the unpredictability of extreme events grows, carriers are either raising premiums or exiting entire markets.

Source: Forbes

AI News Q&A (Free Content)

Q1: How is the unpredictability of climate change affecting traditional insurance models?

A1: Climate change is making traditional insurance models, which rely on historical data, increasingly inaccurate. Extreme weather events that were once rare are now occurring more frequently, leading insurers to either raise premiums or withdraw from certain markets. This increased unpredictability necessitates new models like data-driven parametric insurance, which uses advanced statistical techniques to better predict and manage risks associated with climate change.

Q2: What role does climate-contingent finance play in adapting to climate change?

A2: Climate-contingent finance allows entities to invest in adaptation projects with financial returns linked to specific climate scenarios. This approach helps balance the risks of over-preparation for adapting entities and under-preparation for investors, effectively coordinating investment to mitigate climate change impacts. Such financial frameworks go beyond traditional insurance by creating economic value and reducing physical damage through proactive adaptation initiatives.

Q3: How are legislative initiatives in Europe influencing the insurance industry regarding sustainable development?

A3: In Europe, legislative initiatives like the Solvency II project focus on integrating sustainability into insurance risk management. These initiatives emphasize climate change but also include broader sustainable development goals. Larger insurance companies are better positioned to meet these new expectations, while small- and medium-sized enterprises face challenges due to limited resources. Strategies are being developed to assist these smaller companies in managing sustainability risks effectively.

Q4: What are the implications of climate change on agriculture and food security?

A4: Climate change impacts agriculture through changing weather patterns, affecting crop yields and increasing the risk of simultaneous crop failures. These changes threaten global food security, exacerbating the risk of hunger for millions. However, advancements in agricultural productivity may offset some negative effects. The adaptation measures and future warming scenarios will significantly determine the extent of these impacts.

Q5: How does climate change influence the insurance industry in the United States?

A5: In the United States, climate change leads to more extreme weather events, prompting insurers to revise risk assessments. The industry has seen a rise in weather-related claims, with 88% of property insurance losses from 1980 to 2005 being climate-related. This trend pushes insurers to develop new strategies and products to manage escalating risks effectively.

Q6: What challenges do small- and medium-sized insurance companies face in managing climate-related risks?

A6: Small- and medium-sized insurance companies face challenges in adopting new climate risk management strategies due to limited financial and operational resources. Unlike larger firms, they may struggle to implement complex legislative requirements and innovative insurance models. Tailored strategies are needed to help these companies effectively address sustainability and climate-related risks without incurring prohibitive costs.

Q7: What are the potential solutions for mitigating the economic risks posed by climate change?

A7: Mitigating the economic risks of climate change involves developing innovative financial instruments like climate-contingent finance and parametric insurance. These solutions offer more accurate risk assessments and foster strategic investments in adaptation projects. Additionally, collaboration among stakeholders, including governments, businesses, and insurers, is crucial to creating resilient economic structures that can withstand climate-induced disruptions.

References:

- Climate-Contingent Finance

- Insurance Business and Sustainable Development

- Data-driven Parametric Insurance Framework Using Bayesian Neural Networks

- Effects of climate change on agriculture

- Climate change and insurance in the United States