Summary

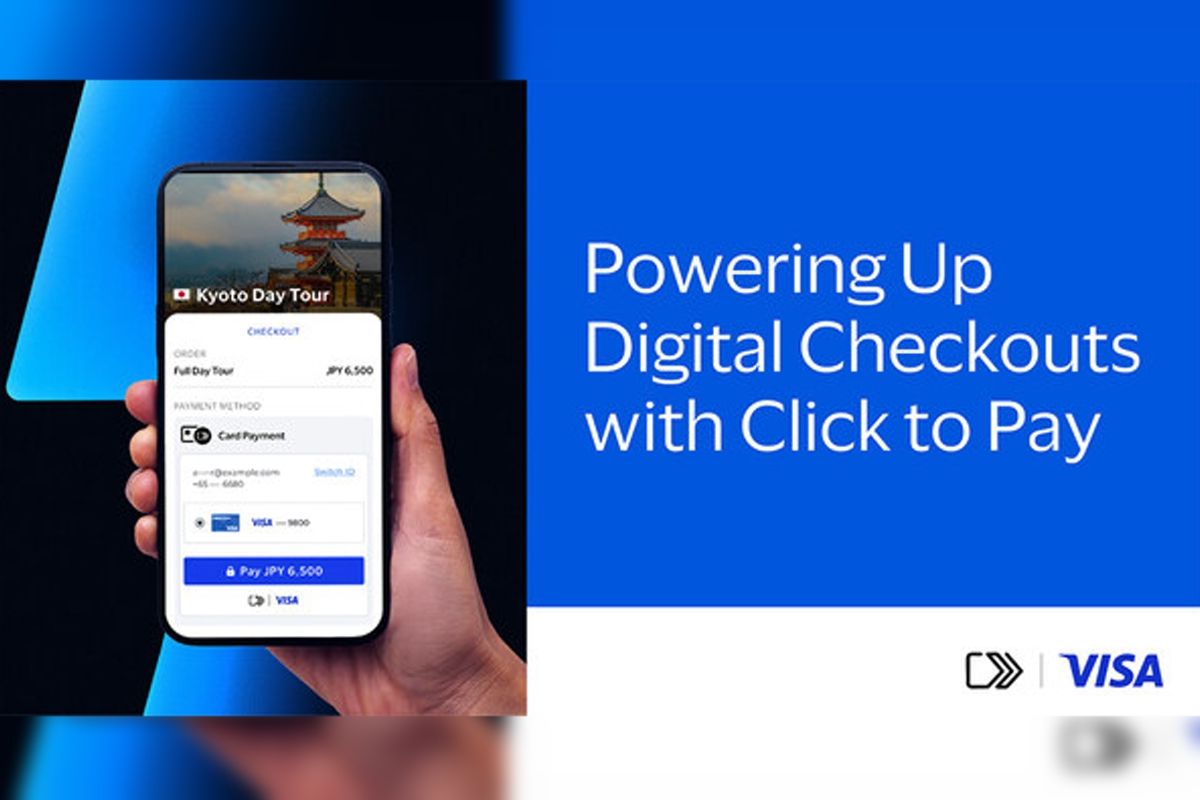

Visa, a global leader in digital payments, has announced today the expansion of Click to Pay across Asia Pacific through strategic partnerships with payment …

Source: en.antaranews.com

AI News Q&A (Free Content)

Q1: What is Visa's Click to Pay and how does it function in the digital payments ecosystem?

A1: Visa's Click to Pay is a digital payment service designed to simplify the online checkout experience. It eliminates the need for entering card details by using a single sign-on system, ensuring a secure and quick transaction process. The service supports various types of cards and works with participating merchants to enhance user convenience.

Q2: How does the expansion of Click to Pay across Asia Pacific impact consumer payment preferences?

A2: The expansion of Click to Pay in Asia Pacific is set to align with the region's growing preference for digital and mobile payments. By integrating local payment methods (LPMs) such as mobile wallets and bank transfers, Visa aims to cater to diverse consumer preferences, enhancing user experience and potentially increasing adoption rates in countries where cash transactions are still prevalent.

Q3: What strategic partnerships has Visa formed to facilitate the rollout of Click to Pay in Asia Pacific?

A3: Visa has partnered with major payment platforms like 2C2P, Adyen, AsiaPay, and Worldpay. These collaborations are crucial for leveraging established networks and technologies to ensure the efficient deployment and operation of Click to Pay across various markets in Asia Pacific.

Q4: What are the potential benefits for merchants in Asia Pacific adopting Visa's Click to Pay?

A4: Merchants in Asia Pacific can benefit from increased conversion rates due to the streamlined checkout process offered by Click to Pay. The integration of local payment options can also attract more customers by providing familiar and trusted methods of payment, ultimately improving customer satisfaction and retention rates.

Q5: How does the integration of local payment methods (LPMs) enhance the effectiveness of Click to Pay in emerging markets?

A5: Integrating LPMs into Click to Pay allows Visa to offer payment solutions that are both convenient and familiar to consumers in emerging markets. This approach addresses the lack of widespread credit card usage and aligns with consumer preferences for mobile wallets and bank transfers, thereby improving accessibility and financial inclusion.

Q6: What challenges might Visa face with the implementation of Click to Pay in Asia Pacific?

A6: Visa could face challenges such as varying regulatory environments across different countries, the need to maintain high security standards, and potential resistance from consumers accustomed to cash transactions. Overcoming these challenges requires careful navigation of local laws and a strong emphasis on security and user education.

Q7: What role do partnerships with payment platforms play in the regional rollout of digital payment solutions like Click to Pay?

A7: Partnerships with payment platforms are pivotal as they provide the necessary infrastructure and local expertise for a successful rollout. These collaborations help in tailoring the service to meet regional demands, ensuring compliance with local regulations, and enhancing the payment ecosystem's overall efficiency.

References:

- Visa policy of India

- Consumer-to-business