Summary

Sustainability Accountability: ESMA Adds Guidance to Avoid Greenwashing Risks

16 January 2026

By Jack Grogan-Fenn

The European Securities and Markets Authority (ESMA) has issued new guidance focused on ESG strategies and presenting its expectations for market participants to avoid the risk of gr…

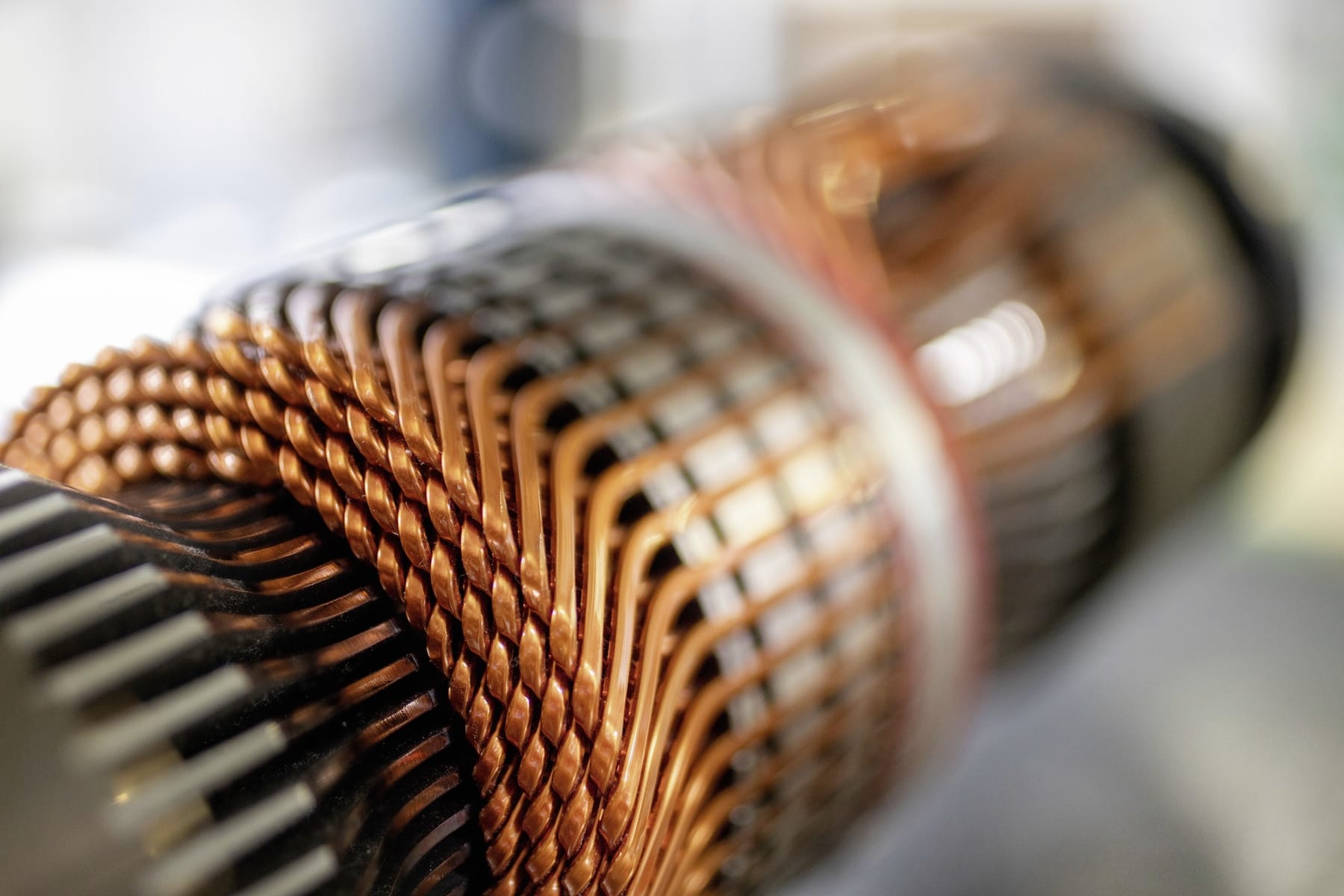

Source: Minerva-Manifest

AI News Q&A (Free Content)

Q1: What are the key principles outlined by the European Securities and Markets Authority (ESMA) to avoid greenwashing in ESG strategies?

A1: ESMA has set out four key principles to avoid greenwashing in ESG strategies: claims must be accurate, accessible, substantiated, and kept up to date. These principles are designed to prevent misleading claims in ESG communications, ensuring that investors can accurately assess the sustainability profile of financial products.

Q2: How has ESMA's guidance impacted the way investment firms communicate their ESG strategies?

A2: ESMA's guidance has prompted investment firms to scrutinize their sustainability communications more carefully. Firms are now expected to clearly explain how they define and apply ESG integration and exclusions in their marketing materials, ensuring that the information is clear, fair, and not misleading.

Q3: What are some of the latest research initiatives addressing greenwashing risks in ESG disclosures?

A3: Recent research includes the development of datasets like A3CG - Aspect-Action Analysis with Cross-Category Generalization, which helps improve the robustness of ESG analysis by linking sustainability aspects with their associated actions. This ensures that ESG insights are grounded in verifiable actions, reducing the risk of greenwashing.

Q4: What role does the ESG-FTSE corpus play in improving ESG relevance detection?

A4: The ESG-FTSE corpus is a collection of news articles with ESG relevance annotations, used to enhance the detection of ESG relevance in media content. By applying quantitative techniques, it helps improve the accuracy of ESG relevance predictions, supporting responsible investing and reducing the potential for greenwashing.

Q5: What sustainability trends are expected to shape corporate strategies in 2026?

A5: In 2026, sustainability is expected to become a core business discipline, influencing strategies across sectors. Key trends include the adoption of circular economies, the growth of net-zero buildings, and the integration of advanced technologies like AI and quantum computing to enhance sustainability efforts and operational efficiency.

Q6: How is the concept of a circular economy expected to evolve by 2026?

A6: By 2026, the shift towards circular economies is anticipated to accelerate, with businesses prioritizing waste reduction and resource efficiency. Companies are implementing global refurbishment programs and sustainable practices to extend product lifecycles and minimize environmental impact, setting industry-wide templates for circular models.

Q7: What challenges do fund managers face in aligning with ESMA's greenwashing guidelines?

A7: Fund managers must ensure that their sustainability statements are clear, fair, and not misleading, aligning with ESMA's guidelines. This involves managing the diverse ESG approaches between different regions, such as the US and Europe, and ensuring consistency in ESG disclosures to mitigate the risk of greenwashing.

References:

- European Securities and Markets Authority - https://en.wikipedia.org/wiki/European_Securities_and_Markets_Authority

- ESMA Guides Investment Firms on Expectations to Avoid Greenwashing in ESG Strategies - https://onestopesg.com/esg-news/esma-guides-investment-firms-on-expectations-to-avoid-greenwashing-in-esg-strategies-1768480255975

- Ropes & Gray Viewpoints - ESMA Tackling Greenwashing Remains Key Priority - https://www.ropesgray.com/en/insights/viewpoints/102k049/esma-2026-2028-tackling-greenwashing-remains-key-priority

- Thematic Notes on Sustainability-Related Claims - https://www.esma.europa.eu/sites/default/files/2026-01/ESMA36-429234738_-165_Thematic_notes_on_sustainability-related_claims-_ESG_strategies.pdf

- ETFSream - ESMA Tightens Guidance on ESG Claims - https://www.etfstream.com/articles/esma-tightens-guidance-on-esg-claims-made-to-retail-investors

- Towards Robust ESG Analysis Against Greenwashing Risks: Aspect-Action Analysis with Cross-Category Generalization

- Measuring Sustainability Intention of ESG Fund Disclosure using Few-Shot Learning