Summary

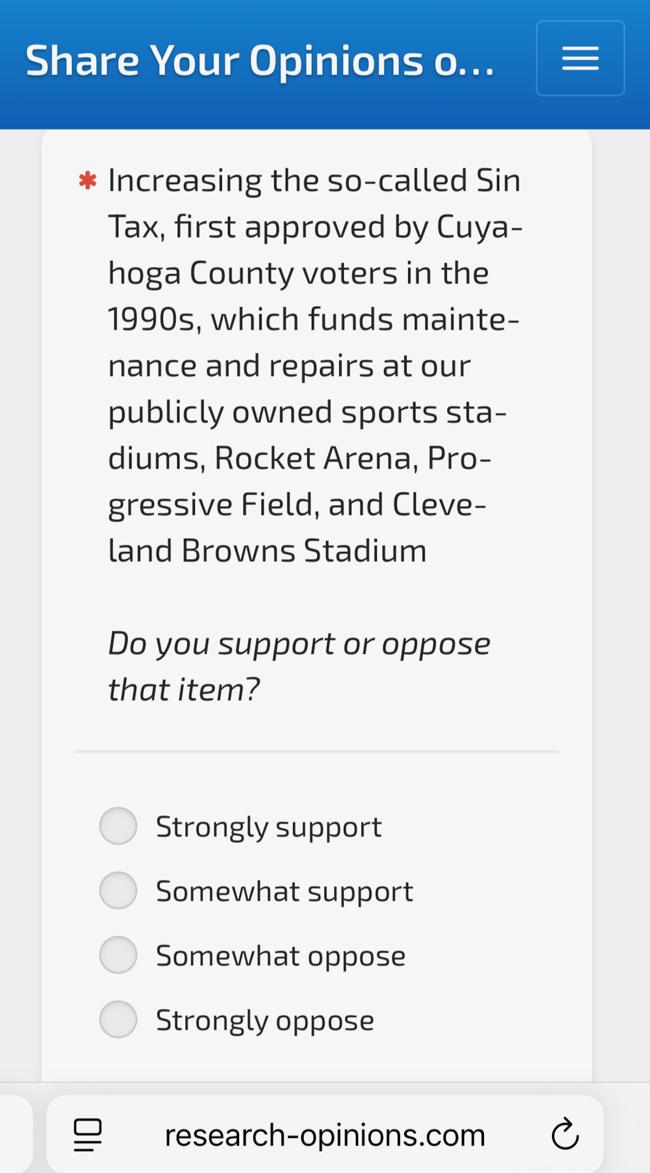

As Cuyahoga County considers raising taxes on beer, liquor, and cigarettes to cover stadium maintenance shortfalls, Today in Ohio podcast questions whether taxpayers have reached their breaking point

Source: cleveland.com

AI News Q&A (Free Content)

Q1: What is a sin tax and how might it impact lower-income communities if applied to products like beer, liquor, and cigarettes in Cuyahoga County?

A1: A sin tax is an excise tax levied on goods considered harmful to individuals and society, such as alcohol and tobacco. These taxes are often regarded as regressive because they disproportionately affect lower-income individuals who tend to spend a higher percentage of their income on these goods. In Cuyahoga County, raising sin taxes to fund stadium maintenance could increase the financial burden on lower-income residents, as the increased costs of these items would take up a larger share of their disposable income compared to wealthier individuals.

Q2: How have similar sin tax proposals historically influenced voter responses in US cities?

A2: Historically, sin tax proposals have received mixed responses from voters. While they can be more popular than other forms of taxation because they target specific consumer goods, there is often pushback when the revenue is used for projects perceived as non-essential, such as stadium funding. In several US cities, voters have shown resistance or demanded more transparency and accountability in how sin tax revenues are allocated, especially when economic pressures like inflation are high.

Q3: What does recent research suggest about the influence of inflation and news coverage on consumer expectations and spending behavior?

A3: Recent studies indicate that news about inflation and monetary policy significantly shapes consumer inflation expectations, which, in turn, influence spending behavior. Exposure to news on rising inflation and easier monetary policy tends to have a stronger impact on households, affecting their planning and consumption patterns. This dynamic was notably observed in the US from 1978 to 2016, with the effects becoming more pronounced during periods of economic uncertainty.

Q4: According to the latest scholarly research, how does access to consumer credit affect spending patterns, particularly in times of inflation?

A4: A 2023 study found that access to consumer credit lines increases overall spending, but as credit limits rise, consumers allocate more spending toward luxury items rather than necessities. This implies that during periods of inflation, when essentials become costlier, increased credit access might not necessarily benefit lower-income households if they're incentivized to spend on non-essential goods, potentially exacerbating financial stress.

Q5: What is the relationship between retail inflation and consumer decision-making regarding discretionary spending, such as attending sports events?

A5: Retail inflation reduces consumers' disposable income, prompting them to prioritize essential expenditures over discretionary spending like attending sports games. As prices on basic goods rise, consumers are less likely to spend on non-essentials, which can impact revenue streams for sectors reliant on discretionary spending, such as sports and entertainment.

Q6: How do regressive taxes like those on alcohol and tobacco compare to Pigouvian taxes in terms of societal goals and economic efficiency?

A6: Regressive taxes like sin taxes are imposed without necessarily accounting for the broader societal costs, often disproportionately impacting low-income populations. In contrast, Pigouvian taxes are designed specifically to internalize the external costs associated with harmful goods (such as healthcare costs from smoking), aiming for economic efficiency and optimal resource allocation by aligning private and social costs.

Q7: What are some potential alternative funding mechanisms for stadium maintenance that avoid placing a disproportionate burden on lower-income residents?

A7: Alternative funding mechanisms include public-private partnerships, targeted user fees (such as ticket surcharges or facility usage fees), and leveraging naming rights or sponsorships. These methods can distribute the funding burden more equitably by aligning costs with those who directly benefit from stadium use, rather than broadly taxing products that are disproportionately consumed by lower-income residents.

References:

- Sin tax - Wikipedia https://en.wikipedia.org/wiki/Sin_tax

- Regressive tax - Wikipedia https://en.wikipedia.org/wiki/Regressive_tax