AI News Q&A (Free Content)

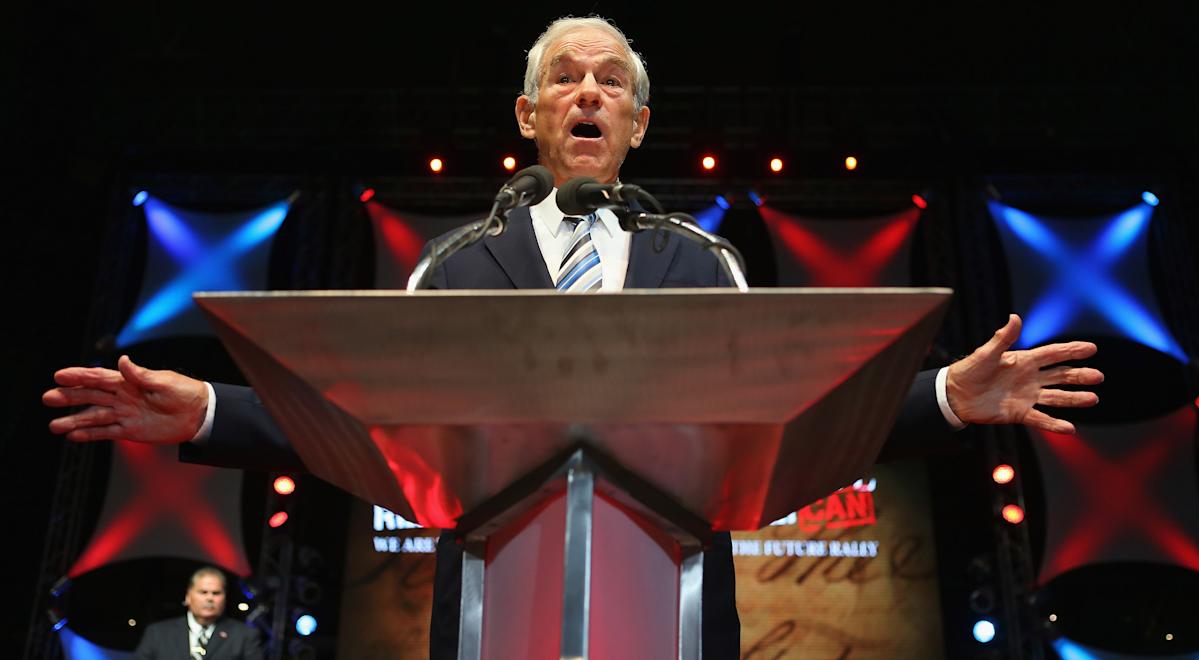

Q1: What is Ron Paul's stance on the U.S. monetary system and the Federal Reserve's role?

A1: Ron Paul has long criticized the U.S. monetary system, particularly the Federal Reserve's control over money supply and interest rates. He believes that the Federal Reserve's ability to print money leads to inflation and devalues savings. Paul advocates for a return to a gold standard and a reduction in government intervention in monetary policy, arguing that these measures would stabilize the economy and protect individual wealth.

Q2: How does fractional-reserve banking impact the money supply and financial stability?

A2: Fractional-reserve banking allows banks to keep only a fraction of their deposit liabilities in reserve, lending out the remainder. This system enables the money supply to expand beyond the base money created by the central bank, potentially leading to economic growth. However, it also poses risks to financial stability, as banks may face liquidity shortfalls if many depositors withdraw funds simultaneously. Central banks mitigate these risks by setting reserve requirements and acting as lenders of last resort.

Q3: What recent advancements have been made in the field of fractional investing?

A3: Recent advancements in fractional investing include the development of platforms that allow investors to purchase fractions of shares, making it more accessible to individuals with limited capital. This democratization of investing enables more people to diversify their portfolios and participate in the stock market. Additionally, advancements in technology have facilitated the growth of automated investment strategies, such as robo-advisors, which offer cost-effective and efficient portfolio management.

Q4: What are the potential benefits and drawbacks of fractional investing for individual investors?

A4: Fractional investing allows individual investors to diversify their portfolios with limited funds, reducing risk by spreading investments across multiple assets. This investment approach also provides greater access to high-value stocks that may be otherwise unaffordable. However, fractional investing can also lead to over-diversification, where the benefits of diversification are diminished. Additionally, investors may face higher costs per share due to platform fees and reduced voting rights in shareholder decisions.

Q5: What is the role of deep learning in active investing, and how does it impact investment strategies?

A5: Deep learning is increasingly being used in active investing to enhance investment strategies by identifying patterns and predicting asset trends. Recent research has shown that end-to-end deep learning frameworks can effectively construct active investment portfolios, from factor selection to stock selection. These advancements enable investors to make data-driven decisions, potentially leading to more profitable outcomes. However, the complexity and reliance on technology may also pose challenges for understanding the underlying investment decisions.

Q6: How has the concept of fractional-reserve banking evolved over time, and what are its implications for modern banking?

A6: Fractional-reserve banking has evolved from a simple method of banks holding a fraction of deposits as reserves to a complex system regulated by central banks. This evolution has been driven by the need to balance economic growth with financial stability. Modern implications include the ability to influence economic activity through monetary policy and credit creation, while also necessitating robust regulatory frameworks to prevent systemic risks.

Q7: What are the key regulatory measures in place to ensure the stability of fractional-reserve banking systems?

A7: Regulatory measures for fractional-reserve banking systems include setting reserve requirements, capital adequacy ratios, and conducting regular stress tests. Central banks also play a crucial role by managing interest rates and acting as lenders of last resort during liquidity crises. These measures are designed to ensure banks have sufficient reserves to meet withdrawal demands and to maintain overall financial system stability.

References:

- Political positions of Ron Paul

- Federal Reserve

- Fractional-reserve banking

- E2EAI: End-to-End Deep Learning Framework for Active Investing

- arxiv.org/abs/2305.12345