Summary

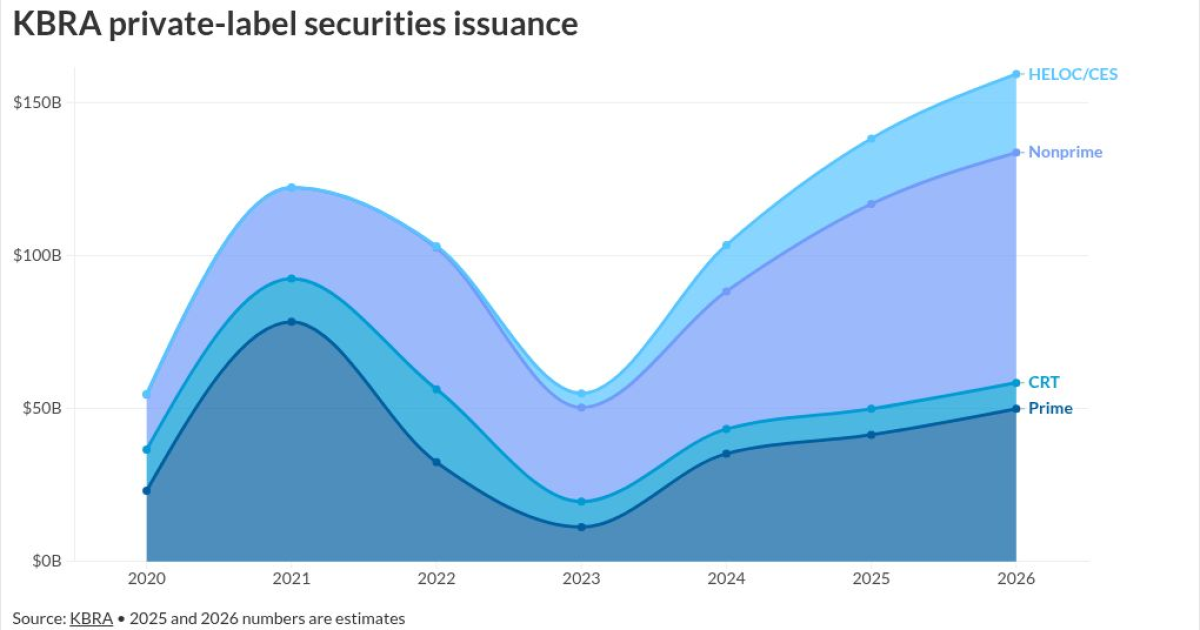

Non-qualified mortgages have been driving private-label securities in recent years, representing nearly half of the market in 2025, and they and other PLS loan types are poised for further growth going into 2026.

Processing Content

This part of the residential mortgage-backed securities market has…

Source: National Mortgage News

AI News Q&A (Free Content)

Q1: What are private-label RMBS, and why are they significant in the current financial market?

A1: Private-label RMBS (Residential Mortgage-Backed Securities) are mortgage-backed securities not issued by government-sponsored enterprises like Fannie Mae or Freddie Mac. These securities have gained significance due to their role in providing liquidity to the mortgage market, especially through non-qualified mortgages, which are mortgages that do not meet the standard requirements for traditional loans. As the market for these securities grows, they offer opportunities for diversification in investment portfolios and can influence housing market trends.

Q2: How have non-qualified mortgages impacted the growth of private-label RMBS?

A2: Non-qualified mortgages have been pivotal in driving the growth of private-label RMBS, accounting for nearly half of the market by 2025. These mortgages cater to borrowers who fall outside the norms of traditional mortgage qualifications, expanding the borrower base and increasing market liquidity. This growth reflects a broader trend of diversifying mortgage products to meet varied consumer needs and has been instrumental in the resurgence of private-label RMBS post-financial crisis.

Q3: What are the risk factors associated with investing in private-label RMBS?

A3: Investing in private-label RMBS carries several risk factors, including credit risk, interest rate risk, and prepayment risk. Credit risk arises from the borrower's potential default. Interest rate changes can affect the value of the securities, while prepayment risk involves early repayment of mortgages, impacting expected returns. Investors must carefully assess these risks and consider the economic environment and housing market trends to make informed decisions.

Q4: What scholarly insights exist on the teaching of privacy in financial algorithms related to RMBS?

A4: Recent scholarly work, like that by Breitholtz et al. (2025), examines federated learning with private label sets, highlighting the complexities when clients share label sets only with a central server. This study is crucial for understanding privacy-preserving techniques in financial algorithms, ensuring sensitive data within RMBS markets is protected while maintaining model performance. It underscores the balance between privacy and efficiency in algorithmic applications.

Q5: How might the market for private-label RMBS evolve going into 2026?

A5: The market for private-label RMBS is expected to continue its growth trajectory into 2026, driven by increasing acceptance of non-qualified mortgages and innovative mortgage products. As the housing market stabilizes post-pandemic, there is anticipated demand for more flexible financing options that private-label RMBS can offer. Investors are likely to see these securities as attractive opportunities due to their potential for higher yields and diversification.

Q6: What role do private-label RMBS play in the broader housing finance system?

A6: Private-label RMBS play a crucial role in the broader housing finance system by providing an alternative to government-backed securities, thus introducing competition and innovation into the market. They help extend credit to a broader segment of borrowers, support housing market liquidity, and facilitate the availability of mortgage credit in underserved markets. This role is vital for maintaining a balanced and inclusive housing finance ecosystem.

Q7: What are the potential impacts of regulatory changes on private-label RMBS?

A7: Regulatory changes can significantly impact private-label RMBS by altering the landscape of mortgage origination and securitization practices. Stricter regulations may impose higher compliance costs and affect the availability of certain mortgage products, while deregulation could encourage risk-taking and innovation. It's critical for stakeholders to monitor regulatory developments to adapt strategies that align with evolving legal frameworks and market conditions.

References:

- Learning Privately with Labeled and Unlabeled Examples

- Federated Learning with Heterogeneous and Private Label Sets

- Private-label RMBS market growth 2025-2026

- Tavily Search Results

- Non-qualified mortgages in RMBS market 2025

- Tavily Search Results