Summary

One of the biggest expenses youll face in retirement is healthcare costs. On this episode of Retirement Report, hosts Hank Parrott and Aristotle McDonald discuss planning for expenses in retirement.

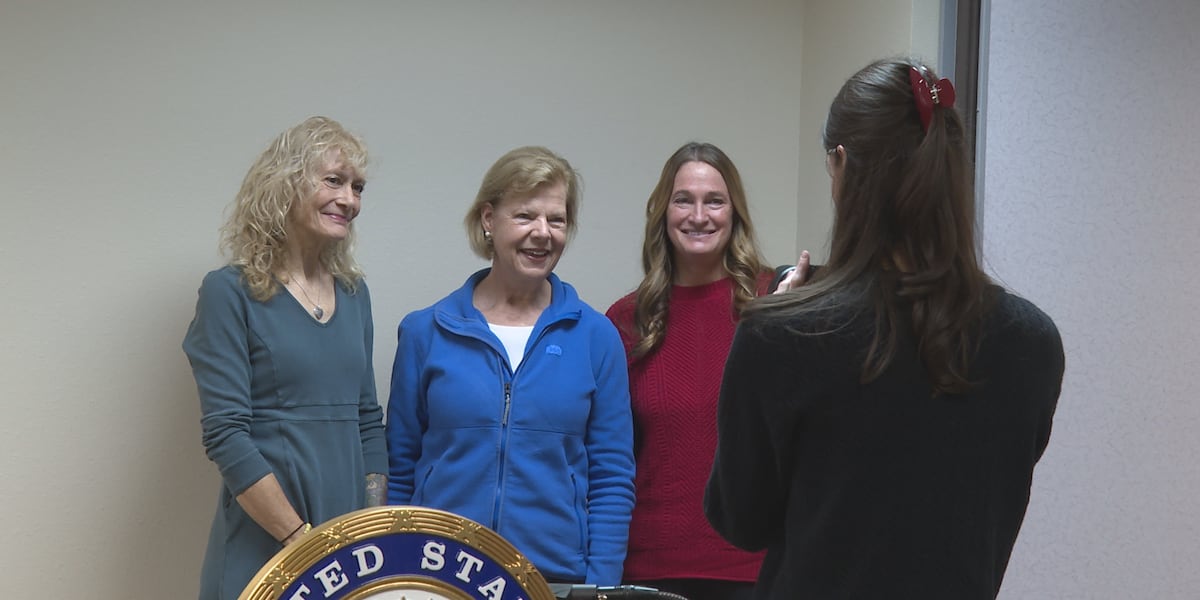

Source: Newschannel 5

AI News Q&A (Free Content)

Q1: What are the key strategies for managing healthcare costs during retirement?

A1: One of the key strategies for managing healthcare costs during retirement is to utilize a Health Savings Account (HSA). HSAs provide a tax-advantaged way to save for medical expenses, with funds rolling over each year if not used. This allows retirees to accumulate savings specifically for healthcare costs, reducing the financial burden during retirement. Additionally, understanding and planning for retirement spend-down, which involves withdrawing assets strategically, can also help manage healthcare costs effectively.

Q2: How does the Health Savings Account (HSA) work for retirees?

A2: Health Savings Accounts (HSAs) are available to individuals with high-deductible health plans. The contributions to HSAs are tax-deductible, and the funds can be used to pay for qualified medical expenses without incurring federal taxes. For retirees, this means they can save money for healthcare expenses and use it tax-free, which can be a significant advantage in managing healthcare costs during retirement.

Q3: What role does the National Health Insurance system play in managing healthcare costs in countries like Japan?

A3: In Japan, the National Health Insurance system is a statutory program that provides healthcare coverage to citizens, residents, and foreigners with long-term visas. It ensures that all individuals have access to essential healthcare services, thereby helping to manage individual healthcare costs effectively. This system reduces the financial burden on retirees who might otherwise face high medical expenses.

Q4: What are the implications of work-related musculoskeletal disorders (WMSDs) for healthcare professionals as they approach retirement?

A4: Work-related musculoskeletal disorders (WMSDs) are prevalent among healthcare professionals, including ophthalmologists, with rates between 63% and 81%. This high prevalence can lead to early retirement or increased healthcare costs for professionals in this field. Therefore, addressing ergonomic challenges and implementing interventions can reduce WMSD risks and potentially extend the working life of healthcare professionals.

Q5: How can retirement planning help in reducing the financial impact of healthcare costs?

A5: Retirement planning involves preparing for the spend-down phase, where retirees rely on accumulated assets to meet their financial needs. By planning early and considering factors like health insurance options, potential medical expenses, and personal savings strategies such as HSAs, retirees can better manage and reduce the financial impact of healthcare costs.

Q6: What are the benefits and drawbacks of Health Savings Accounts (HSAs) in retirement?

A6: The benefits of HSAs in retirement include tax advantages, the ability to pay for qualified medical expenses tax-free, and the accumulation of funds over time. However, drawbacks include the requirement to have a high-deductible health plan to qualify, which might not be suitable for everyone, and the potential complexity in managing healthcare expenses against retirement savings goals.

Q7: How do ergonomic interventions in healthcare settings contribute to reducing healthcare costs for professionals nearing retirement?

A7: Ergonomic interventions in healthcare settings, such as improved equipment design and ergonomic training, can reduce the risk of work-related musculoskeletal disorders among professionals. By decreasing the incidence of these disorders, healthcare costs associated with treatment and potential early retirement due to disability can be significantly reduced, benefiting both individuals and healthcare systems.

References:

- Health savings account

- Retirement spend-down

- National Health Insurance (Japan)

- A scoping review of ergonomics in ophthalmology Part 1: Working in Pain.