Summary

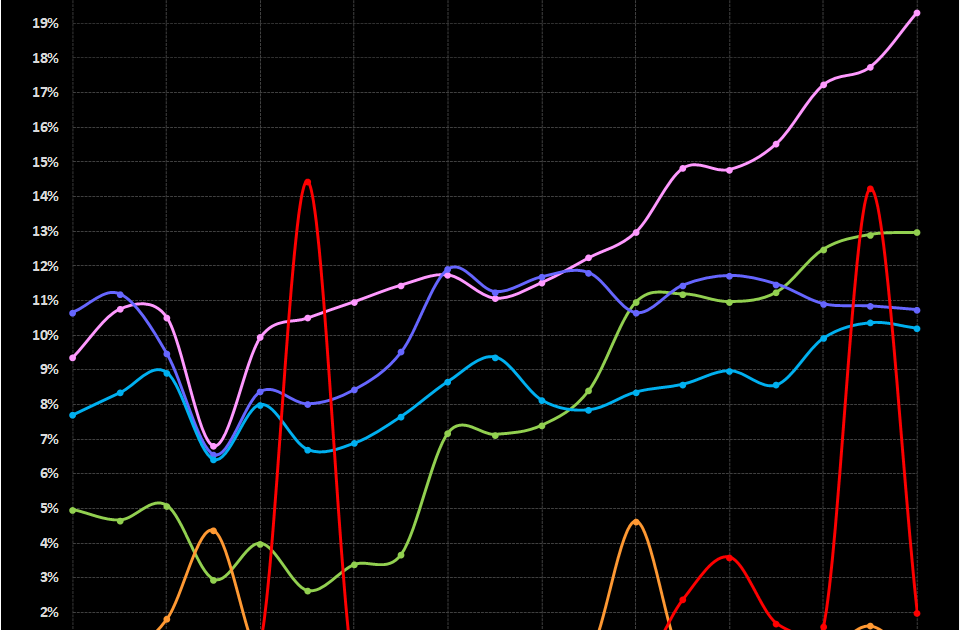

The office sector distress rate finished February at 19.3 percent, an increase of 160 basis from January, according to CRED iQ.

Source: Commercial Observer

AI News Q&A (Free Content)

Q1: What does the increase in the office CMBS loan distress rate signify for the commercial real estate market?

A1: The increase in the office CMBS loan distress rate to 19.3% in February 2023 indicates rising financial difficulties within the commercial real estate sector. This can be attributed to factors such as reduced demand for office spaces due to remote work trends, economic uncertainties, and higher interest rates, which increase borrowing costs.

Q2: How does the current office CMBS loan distress rate compare to historical levels?

A2: The current distress rate of 19.3% is notably higher than historical averages, reflecting a significant stress in the market. Historically, rates have varied, but this spike is comparable to levels seen during financial crises, indicating potential systemic risks within the sector.

Q3: What are the potential economic impacts of a high CMBS loan distress rate?

A3: A high CMBS loan distress rate can lead to increased foreclosures and devaluation of commercial properties. This may result in reduced property tax revenues for local governments and financial losses for investors holding these securities, potentially affecting broader economic stability.

Q4: How does the CMBS loan distress rate relate to consumer financial vulnerability?

A4: The CMBS loan distress rate reflects broader financial vulnerabilities, similar to those seen in consumer lending markets. As demonstrated in recent research, financial distress can be exacerbated by economic conditions, impacting both commercial and consumer borrowers.

Q5: What role do interest rates play in the office CMBS loan distress rate?

A5: Interest rates directly impact the cost of borrowing for office space investments. Higher rates increase loan servicing costs, contributing to financial distress. This is compounded by economic factors that reduce demand for office spaces, magnifying distress levels.

Q6: Are there any recent technological solutions being explored to address financial distress in real estate?

A6: Recent research highlights the use of data-driven tools and automation for better financial management and decision-making in real estate. These technologies aim to optimize asset management and reduce the risks of financial distress through predictive analytics.

Q7: What measures can policymakers take to mitigate the impact of rising CMBS loan distress rates?

A7: Policymakers can implement supportive fiscal policies, provide incentives for office space utilization, and encourage investment in adaptive reuse of commercial properties. Moreover, monitoring financial institutions' exposure to distressed assets can help manage systemic risks.

References:

- Detecting Consumers' Financial Vulnerability using Open Banking Data: Evidence from UK Payday Loans

- A Brief Wellbeing Training Session Delivered by a Humanoid Social Robot: A Pilot Randomized Controlled Trial