Summary

Circle’s USDC is the second most popular stablecoin on the market. Circle’s revenue is highly dependent on factors completely outside of its control. Since its initial public offering (IPO) last month,

Source: The Motley Fool on MSN.com

AI News Q&A (Free Content)

Q1: What are the key factors that influence the revenue generation of Circle Internet Financial?

A1: Circle Internet Financial primarily generates revenue through its management of the stablecoin USDC, which is pegged to the U.S. dollar. The company’s revenue is highly dependent on external factors such as interest rates and the demand for stablecoins in the cryptocurrency market. Since USDC is backed by short-term U.S. government securities, fluctuations in interest rates can significantly impact Circle's revenue stream.

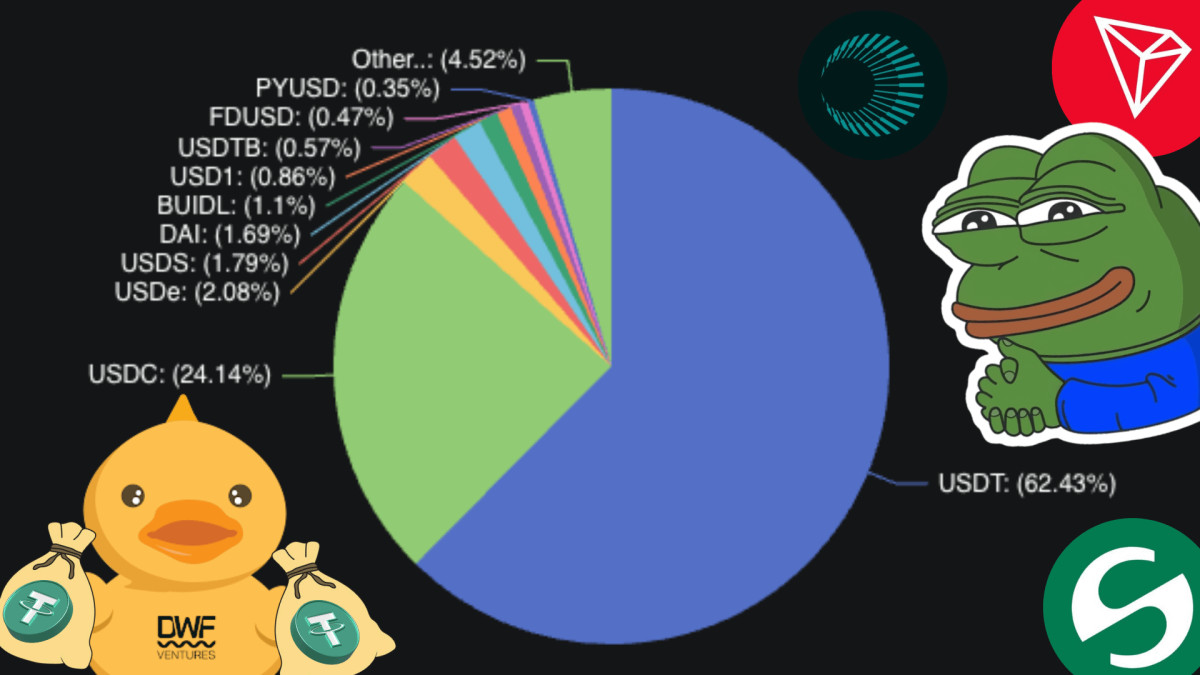

Q2: How does the market position of USDC compare to other stablecoins in 2023?

A2: As of 2023, USDC is the second-largest stablecoin in the market. It is designed to maintain a stable price of $1 and is backed by U.S. government securities. USDC has gained significant traction due to its stability and regulatory compliance, positioning it as a major competitor to other stablecoins like Tether (USDT). The market cap of stablecoins has been growing, with USDC playing a pivotal role in this expansion.

Q3: What are the potential regulatory challenges faced by stablecoins, as discussed in recent scholarly articles?

A3: Stablecoins face several regulatory challenges, including the need for enhanced oversight to ensure stability and compliance with financial regulations. A recent paper highlights the critical regulatory considerations that constrain stablecoins, such as the need for stringent collateral management and the evaluation of the source of collateral. These challenges are crucial for maintaining the integrity and trustworthiness of stablecoins in the financial ecosystem.

Q4: How did Circle Internet Financial transition from its founding to its current status as a significant player in the cryptocurrency market?

A4: Circle Internet Financial was founded in 2013 by Jeremy Allaire and Sean Neville with the aim of bringing digital currency benefits to mainstream consumers. Initially focused on peer-to-peer payments, Circle has since evolved into a major player in the cryptocurrency market by managing USDC, a highly popular stablecoin. The company's strategic acquisitions, such as SeedInvest, have further solidified its market presence and expanded its financial technology capabilities.

Q5: What innovative models have been proposed for stablecoin trading, and how do they compare to existing models?

A5: Recent research introduces innovative models like Silkswap, designed for efficient stablecoin trading with minimal price impact. Silkswap is an automated market maker model that uses an asymmetric price impact curve to facilitate trading. This model is compared to the well-known Curve Finance model, highlighting its unique features and advantages in terms of trading efficiency and stability.

Q6: What are the different types of stablecoins, and what are the trade-offs associated with each?

A6: Stablecoins can be classified into four types based on their collateral source and management. These include fiat-collateralized, crypto-collateralized, algorithmic, and hybrid stablecoins. Each type has its trade-offs, such as stability versus decentralization, and requires careful evaluation of collateral management mechanisms to ensure stability. Understanding these trade-offs is crucial for investors and regulators to make informed decisions.

Q7: What role does Circle's acquisition strategy play in its overall business growth and market expansion?

A7: Circle's acquisition strategy, including the purchase of SeedInvest, plays a significant role in its growth and market expansion. By acquiring companies that complement its core business, Circle enhances its technological capabilities and broadens its market reach. These strategic acquisitions have enabled Circle to diversify its offerings and strengthen its position in the financial technology and cryptocurrency sectors.

References:

- Circle (company) - https://en.wikipedia.org/wiki/Circle_(company)

- Silkswap: An asymmetric automated market maker model for stablecoins - https://arxiv.org/abs/2301.09521

- From Tether to Libra: Stablecoins, Digital Currency and the Future of Money - https://arxiv.org/abs/2005.12317

- The four types of stablecoins: A comparative analysis - https://arxiv.org/abs/2308.06789