Summary

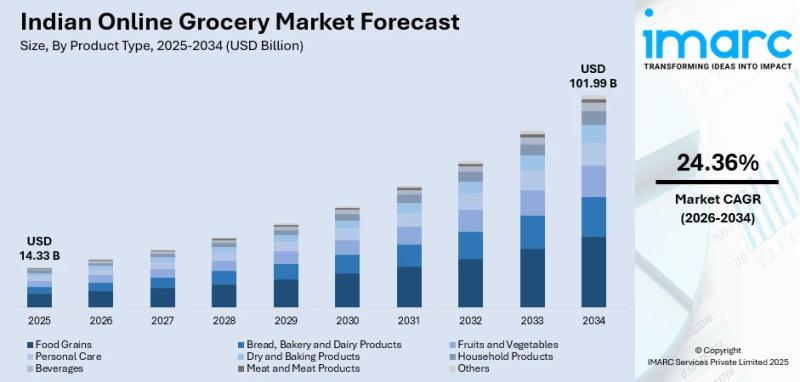

Indian Online Grocery Market Size to Surpass USD 101.99 Billion by 2034 | Expanding at 24.36% CAGR

Indian Online Grocery Market 2026-2034

https://www.imarcgroup.com/indian-online-grocery-market/requestsample

https://www.imarcgroup.com/request?type=report&id=2229&flag=E

https://www.imarcgroup.com…

Source: openPR.com

AI News Q&A (Free Content)

Q1: What factors are driving the growth of the Indian online grocery market, and how does it impact consumer behavior?

A1: The growth of the Indian online grocery market is fueled by increasing digital infrastructure, smartphone penetration, and consumer preferences for convenience. The market is expected to grow from USD 14.33 billion in 2025 to USD 101.99 billion by 2034, at a CAGR of 24.36%. This growth is driven by the rapid expansion of digital payments, quick commerce models, and efficient delivery networks, which cater to the demand for convenient and timely grocery shopping. Consumers are increasingly opting for online platforms due to competitive pricing, diverse product offerings, and improved user experiences.

Q2: How do technological advancements contribute to the Indian online grocery market's expansion?

A2: Technological advancements, including AI-driven personalization, seamless digital payments, and improved supply chain logistics, significantly contribute to the online grocery market's expansion in India. These technologies enhance user experience, streamline operations, and increase market penetration, particularly in tier-two and tier-three cities. The integration of these technologies leads to better customer retention, increased sales, and an overall efficient market ecosystem.

Q3: What challenges does the Indian online grocery market face, and how are they being addressed?

A3: The Indian online grocery market faces challenges such as product quality control, freshness concerns, and logistical inefficiencies. To address these, companies are investing in cold chain logistics, last-mile delivery solutions, and robust supply chain infrastructure. They are also leveraging AI for inventory management and ensuring quality by implementing stringent quality checks and customer feedback mechanisms.

Q4: What role do AI and digital payments play in the future of the Indian online grocery market?

A4: AI and digital payments are pivotal in shaping the future of the Indian online grocery market. AI enhances user experience through personalization, predictive analytics, and efficient inventory management. Digital payments facilitate seamless transactions, increase consumer trust, and reduce transaction times. Together, they drive consumer engagement, improve operational efficiency, and support the market's rapid growth.

Q5: How is the Indian online grocery market expected to impact traditional retail formats?

A5: The rise of the online grocery market is expected to impact traditional retail formats by shifting consumer preferences towards digital platforms. Traditional retailers may experience reduced foot traffic as consumers opt for the convenience and variety offered by online shopping. However, this also presents an opportunity for brick-and-mortar stores to innovate and integrate online strategies to enhance their offerings and remain competitive.

Q6: What economic impact does the growth of the Indian online grocery market have on the broader economy?

A6: The growth of the Indian online grocery market contributes to the broader economy by creating new jobs in logistics, technology, and customer service sectors. It also attracts investments in digital infrastructure and technology, fostering innovation and entrepreneurship. The market's expansion supports ancillary industries such as packaging, transportation, and warehousing, further stimulating economic growth.

Q7: What strategies are online grocery platforms in India adopting to increase market penetration?

A7: Online grocery platforms in India are adopting strategies such as expanding into tier-two and tier-three cities, offering competitive pricing, and enhancing user experience through AI-driven personalization. They are also investing in robust supply chain networks and last-mile delivery solutions to ensure timely delivery and product freshness. Additionally, platforms are forming strategic partnerships with local suppliers to diversify product offerings and meet local consumer demands.