Summary

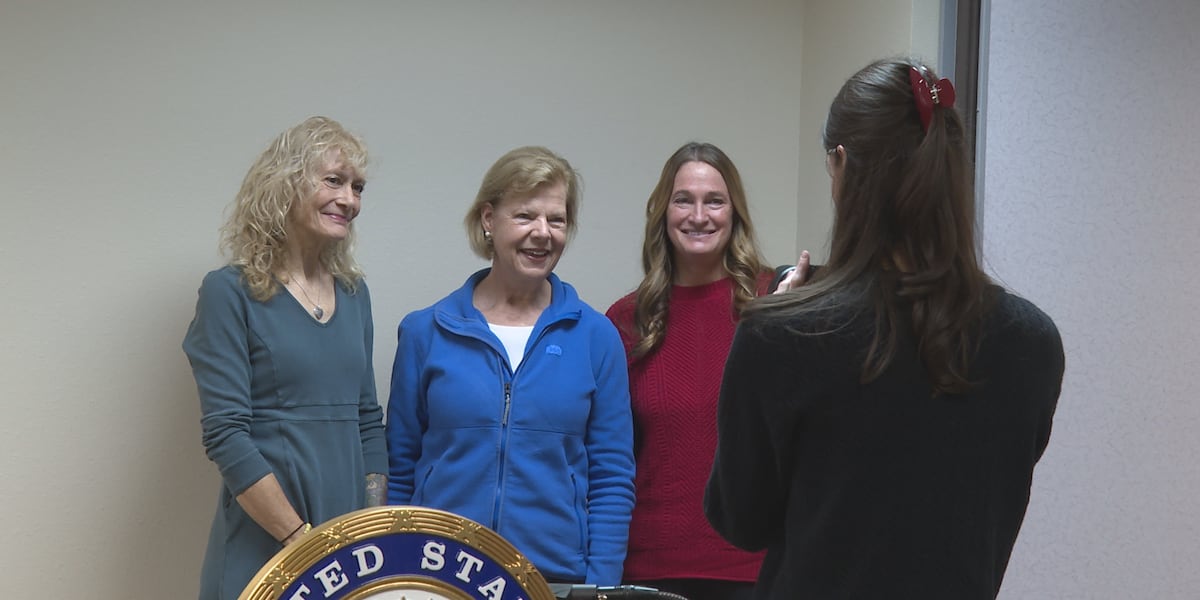

WAUSAU, Wis. (WSAW) – Central Wisconsinites who rely on federal marketplace health insurance are weighing difficult choices as Affordable Care Act premium tax credits are set to expire at the end of the year.

Dawn Lass, a former teacher from Stevens Point, said her familys monthly premium will jum…

Source: WSAW

AI News Q&A (Free Content)

Q1: What are the Affordable Care Act premium tax credits, and how do they work?

A1: The Affordable Care Act (ACA) premium tax credits are subsidies provided by the U.S. federal government to help lower- and middle-income individuals and families afford private health insurance. These credits are designed to reduce the cost of insurance premiums for those who purchase coverage through ACA-established health exchanges. Eligibility is typically limited to households earning between 100% and 400% of the federal poverty level, though recent legislation has expanded eligibility. In 2023, over 14 million people benefited from these credits.

Q2: How is the expiration of ACA premium tax credits affecting families in Central Wisconsin?

A2: The expiration of the ACA premium tax credits is leading to significant uncertainty for families in Central Wisconsin. As these credits expire, many are facing the prospect of increased health insurance premiums, which could lead to financial strain and difficult choices regarding their healthcare coverage.

Q3: What was the impact of terminating cost-sharing reductions payments on insurance plan choices?

A3: The termination of cost-sharing reductions (CSRs) payments in 2017 led insurers to increase premiums to offset the loss. As a result, there was an increase in advanced premium tax credits for enrollees. Consequently, more low-income enrollees opted for cheaper bronze plans, and fewer chose silver plans, indicating a shift towards less expensive health insurance options due to changes in subsidy channels.

Q4: What are the potential consequences for healthcare access if ACA premium tax credits expire?

A4: If ACA premium tax credits expire, many individuals may face increased healthcare costs, leading to decreased access to necessary medical services. This could result in a rise in uninsured individuals or those underinsured, potentially exacerbating health disparities and impacting overall public health.

Q5: How have public subsidies for private health insurance in the U.S. impacted equity in healthcare?

A5: The U.S. healthcare system's subsidy structure for private insurance creates disparities in equity. Employer-based plans offer tax exclusions on premiums, while Marketplace plans provide different subsidy mechanisms. This differentiation can affect the financial burden on individuals and influence the distribution of healthcare costs, thereby impacting horizontal and vertical equity.

Q6: What are the scholarly perspectives on optimizing tax deductions in relation to health insurance?

A6: Recent scholarly work has focused on the optimal strategy for tax deductions to minimize taxation while maximizing benefits, particularly in the context of health insurance. Analytical models suggest conditions under which taxpayers can optimize their deductions, balancing the probability of tax penalization with financial benefits.

Q7: What legislative measures have been proposed to address the challenges of health insurance affordability?

A7: Legislative measures like the American Rescue Plan Act of 2021 and the Inflation Reduction Act have sought to expand eligibility for ACA premium tax credits beyond the traditional income limits, aiming to make health insurance more affordable. These efforts reflect ongoing policy debates about how best to ensure access to affordable healthcare for all Americans.

References:

- Premium tax credit

- The impact of terminating cost-sharing reductions payments on health insurance plan choices

- Horizontal and vertical equity and public subsidies for private health insurance in the U.S.

- Taxpayer deductions and the endogenous probability of tax penalisation