Summary

BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”) short for Blockchain Technology Consensus Solutions, a blockchain technology-focused company, today

Source: FinanzNachrichten.de

AI News Q&A (Free Content)

Q1: What is the significance of BTCS Inc.'s recent announcement to raise $100 million for Ethereum acquisition?

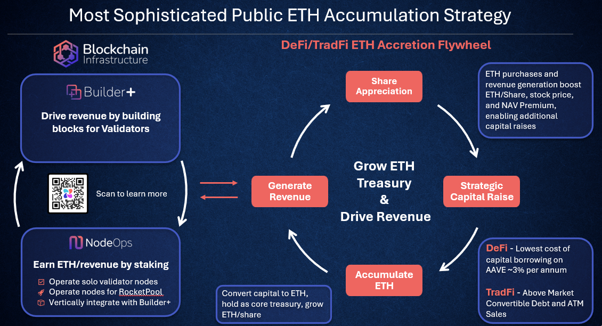

A1: BTCS Inc.'s announcement to raise $100 million for Ethereum acquisition highlights the company's strategic move to strengthen its position in blockchain technology. This investment is intended to leverage both DeFi (Decentralized Finance) and TradFi (Traditional Finance) mechanisms, potentially enhancing BTCS's financial capabilities and market influence in the cryptocurrency sector.

Q2: How does BTCS Inc. integrate DeFi and TradFi in its business operations?

A2: BTCS Inc. integrates DeFi and TradFi by utilizing decentralized platforms for staking digital assets, thus offering a blend of traditional financial systems and innovative blockchain solutions. This integration enables BTCS to provide enhanced transparency and efficiency in financial transactions, possibly attracting a broader investor base.

Q3: What are the potential benefits and risks of BTCS Inc.'s move into Ethereum acquisition using DeFi/TradFi?

A3: The potential benefits include increased market capitalization and diversification of assets, while the risks involve market volatility and regulatory uncertainties in the cryptocurrency domain. The combination of DeFi and TradFi could provide a balanced approach, yet it poses challenges in maintaining stability and compliance.

Q4: What insights does the paper 'DeFi versus TradFi: Valuation Using Multiples and Discounted Cash Flows' provide for companies like BTCS?

A4: The paper suggests that DeFi tokens, despite market fluctuations, may be overvalued when compared using traditional valuation methods like multiples and discounted cash flows. For companies like BTCS, this insight emphasizes the need for careful evaluation of DeFi investments to avoid overvaluation risks.

Q5: Why is the Total Value Locked (TVL) metric considered flawed in the DeFi space, as discussed in recent research?

A5: The TVL metric is considered flawed due to its susceptibility to manipulation through activities like double counting. Recent research proposes the Total Value Redeemable (TVR) as a more reliable framework, revealing that TVL's instability may lead to misleading assessments of DeFi's true value.

Q6: How has BTCS Inc. evolved since its inception, and what are its key milestones?

A6: BTCS Inc. has evolved by becoming the first cryptocurrency company listed on the American stock exchange, pioneering Bitcoin dividends for shareholders, and developing the ChainQ blockchain analytics platform. These milestones reflect BTCS's commitment to innovation in blockchain technology.

Q7: What role does the JANUS Stablecoin protocol play in bridging DeFi and TradFi, and how might it impact companies like BTCS?

A7: The JANUS Stablecoin protocol aims to bridge DeFi and TradFi by offering a dual-token system and AI-driven stabilization to manage decentralization, capital efficiency, and safety-stability. For companies like BTCS, adopting such protocols could enhance their financial resilience and adaptability in the evolving digital economy.

References:

- BTCS Inc. - https://en.wikipedia.org/wiki/BTCS_Inc.

- JANUS: A Stablecoin 3.0 Blueprint for Navigating the Stablecoin Trilemma Through Dual-Token Design, Multi-Collateralization, Soft Peg, and AI-Driven Stabilization - Stylianos Kampakis

- DeFi versus TradFi: Valuation Using Multiples and Discounted Cash Flows - Teng Andrea Xu, Jiahua Xu, Kristof Lommers

- Piercing the Veil of TVL: DeFi Reappraised - Yichen Luo, Yebo Feng, Jiahua Xu, Paolo Tasca