Summary

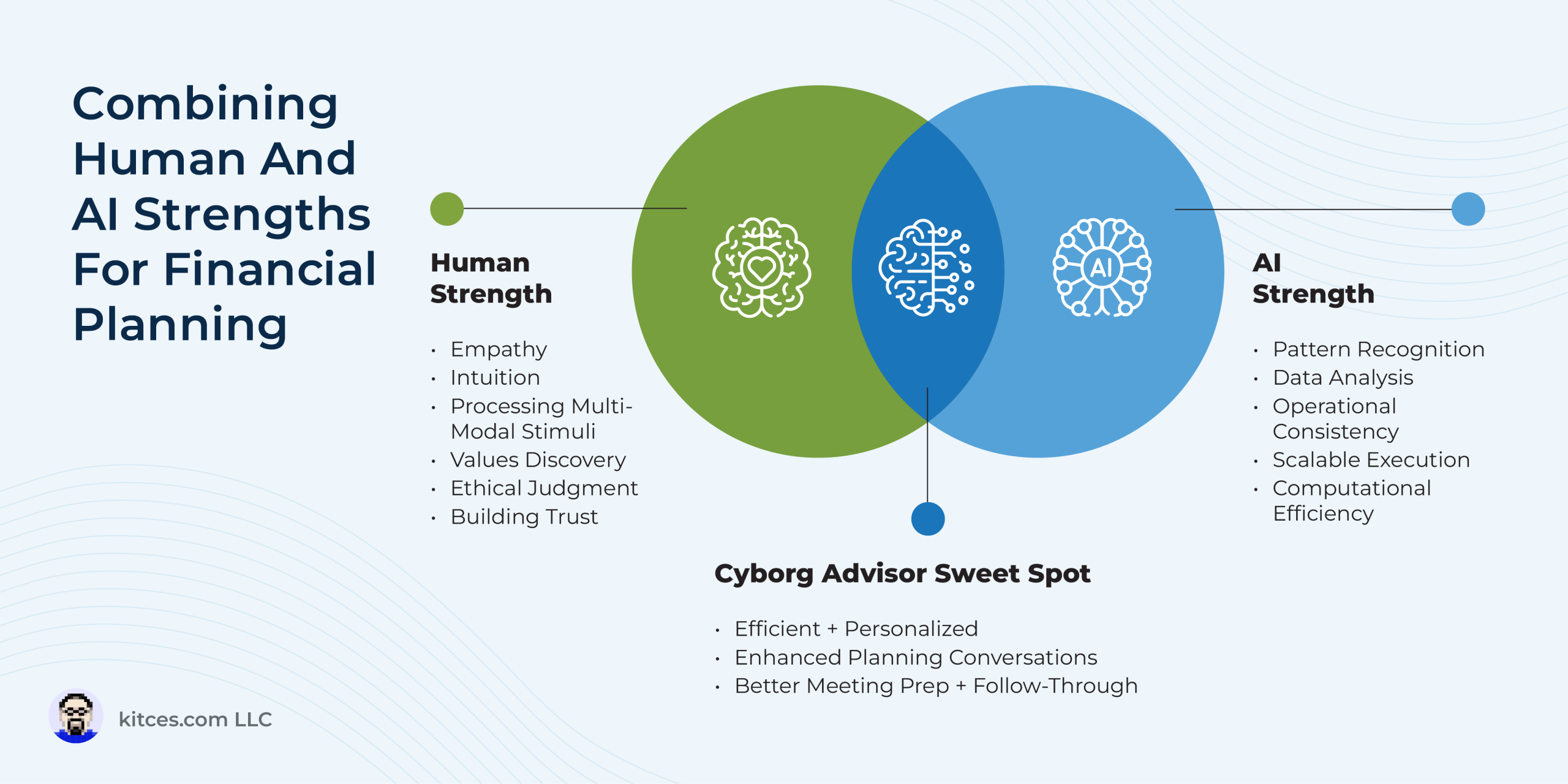

This emerging hybrid model of the cyborg advisor blends the precision of machines with the emotional intelligence and nuanced judgment of human professionals.

Source: kitces.com

AI News Q&A (Free Content)

Q1: What is a cyborg advisor and how does it differ from traditional financial advisory models?

A1: A cyborg advisor is a technology-aided financial professional who combines robo-advice with personalized human counseling. Unlike traditional models, cyborg advisors use data from applications for decision-making while incorporating human elements to offer tailored advice that considers a client's personal needs and preferences.

Q2: How is artificial intelligence transforming financial decision-making processes?

A2: Artificial intelligence is revolutionizing financial decision-making by offering enhanced accuracy, efficiency, and predictive capabilities. AI-driven tools like machine learning and natural language processing enable better investment strategies, risk assessments, credit scoring, and fraud detection, ultimately leading to more resilient and intelligent financial ecosystems.

Q3: What role does machine learning play in understanding investor behavior?

A3: Machine learning plays a critical role in modeling investor behavior by analyzing financial advisors' notes to predict investor needs during market volatility. This helps advisors provide behavioral coaching to avoid poor decision-making. Machine learning techniques such as topic modeling and supervised classification are used to gain insights into advisor-investor interactions.

Q4: What are some challenges associated with AI in financial decision-making?

A4: While AI offers transformative potential in financial processes, challenges include the need for high-quality data, robust model training, and ongoing validation. Ensuring accuracy and reliability requires addressing these challenges, as well as balancing technological advancements with regulatory requirements.

Q5: How does the integration of AI impact customer engagement in finance?

A5: AI enhances customer engagement by predicting behavior and preferences, leading to personalized interactions and improved customer support. Financial institutions use AI to improve efficiency and decision-making, offering innovative products and services tailored to individual needs.

Q6: What insights have been gained from analyzing financial transactions for investor behavior?

A6: Analyzing financial transactions using a behavioral finance model reveals that transaction frequency and volume are more informative of investor behavior than traditional 'Know Your Client' information. This suggests that financial advisors should use advanced metrics to better predict and understand client behaviors.

Q7: What are the future prospects for cyborg advisors in the financial industry?

A7: The future prospects for cyborg advisors are promising as they represent a hybrid model that leverages both technology and human expertise. By combining data-driven insights with emotional intelligence, cyborg advisors can offer comprehensive and behaviorally accountable client solutions, making them a valuable asset in the financial advisory landscape.

References:

- Investor Behavior Modeling by Analyzing Financial Advisor Notes: A Machine Learning Perspective

- Know Your Clients' behaviours: a cluster analysis of financial transactions