Summary

How companies like MicroStrategy and SharpLink are using crypto treasury strategies to reshape corporate finance with bitcoin and Ethereum.

Source: Forbes

AI News Q&A (Free Content)

Q1: How is MicroStrategy utilizing Bitcoin in its corporate strategy?

A1: MicroStrategy has positioned itself as a major player in the cryptocurrency space by investing heavily in Bitcoin. As of December 2024, MicroStrategy holds approximately 423,650 bitcoins, which are valued at $42.43 billion. This strategy aligns with the company's vision of Bitcoin as a digital asset that can serve as a store of value. The company's executive chairman, Michael J. Saylor, has been a vocal advocate for Bitcoin, viewing the firm's investments as a form of a Bitcoin spot leveraged ETF. This strategic move has made MicroStrategy's stock a proxy for Bitcoin investment. By leveraging Bitcoin, MicroStrategy aims to hedge against inflation and currency devaluation, thereby reshaping its corporate finance approach.

Q2: What are the key findings of recent studies on crypto asset pricing?

A2: According to a study titled 'Empirical Crypto Asset Pricing' by Adam Baybutt, crypto assets are identified as a new and independent asset class with distinctive attributes. The study highlights that crypto asset returns are predominantly driven by univariate financial factors, which are functions of previous returns, suggesting that these returns are speculatively driven rather than based on fundamental pricing factors. The research underscores the complexity and volatility inherent in crypto asset pricing, indicating that traditional financial metrics may not fully capture the dynamics of crypto markets.

Q3: What are the strategic implications of incorporating cryptocurrencies like Bitcoin and Ethereum into corporate treasuries?

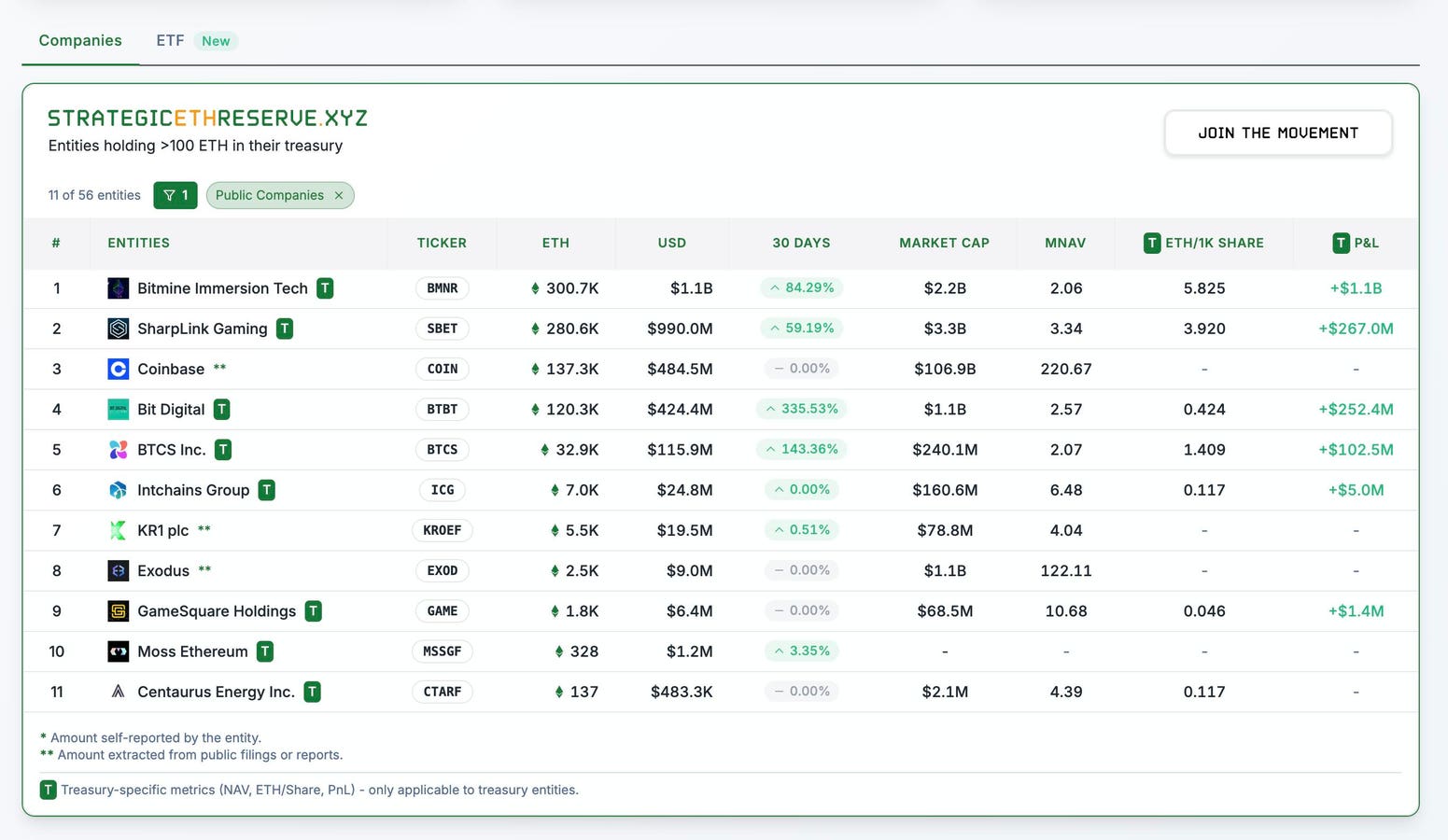

A3: The integration of cryptocurrencies such as Bitcoin and Ethereum into corporate treasuries can provide companies with a hedge against inflation and currency risk. This strategy is particularly appealing in the current economic climate, where traditional fiat currencies may be subject to devaluation. By holding cryptocurrencies, companies can potentially benefit from appreciation in value. However, this approach also comes with risks, including regulatory scrutiny, price volatility, and the need for secure storage solutions. Companies like MicroStrategy and SharpLink are at the forefront of this trend, using crypto assets to diversify their financial strategies and leverage potential long-term gains.

Q4: How does the concept of a 'strategic bitcoin reserve' impact the perception of cryptocurrencies as assets?

A4: The establishment of a 'strategic bitcoin reserve' by the United States, as announced in March 2025, underscores the growing acceptance of Bitcoin as a significant asset class. This reserve is intended to capitalize on Bitcoin already owned by the federal government, highlighting its role as a strategic resource. The initiative reflects a broader trend of institutional adoption and legitimization of cryptocurrencies. However, it has also sparked debate among economists and policy makers, with some viewing it as a speculative endeavor while others see it as a step towards cementing the U.S. as a leader in the crypto space.

Q5: What role does Ethereum play in corporate treasury strategies, especially in comparison to Bitcoin?

A5: Ethereum, like Bitcoin, is increasingly being considered for inclusion in corporate treasury strategies due to its unique capabilities beyond being a digital currency. Ethereum's blockchain supports smart contracts and decentralized applications, offering additional utility for businesses. Unlike Bitcoin, which is primarily viewed as a store of value, Ethereum's potential lies in its programmable blockchain, which can facilitate a wide range of applications. This distinction makes Ethereum attractive to companies looking to innovate and streamline operations through blockchain technology. However, its volatility and regulatory considerations remain critical factors for corporate treasuries.

Q6: What are the challenges faced by companies like SharpLink in adopting crypto treasury strategies?

A6: Companies like SharpLink face several challenges when adopting crypto treasury strategies. These include regulatory uncertainties, as the legal framework for cryptocurrencies is still evolving in many jurisdictions. Market volatility is another significant concern, as the value of cryptocurrencies can fluctuate wildly within short periods. Additionally, there is the challenge of cybersecurity, as storing and managing digital assets requires robust security measures to prevent theft and loss. Despite these challenges, companies are drawn to the potential for high returns and the diversification benefits that crypto assets can bring to their financial portfolios.

Q7: How does the volatility of cryptocurrencies affect their use in corporate finance?

A7: The volatility of cryptocurrencies is a double-edged sword in corporate finance. On one hand, it offers the potential for significant gains, which can enhance a company's financial position. On the other hand, this volatility introduces substantial risk, as the value of crypto holdings can decrease sharply, impacting the company's balance sheet. Companies must carefully weigh these factors when integrating cryptocurrencies into their financial strategies. To mitigate risks, some firms employ hedging strategies or limit their crypto exposure as a percentage of their total assets. The high-risk, high-reward nature of cryptocurrencies necessitates a strategic and cautious approach.

References:

- MicroStrategy - Wikipedia

- Empirical Crypto Asset Pricing - Arxiv.org

- Cryptocurrency - Wikipedia

- Bitcoin - Wikipedia